(, June 30, 2025 ) The global Insurtech market is experiencing a profound transformation driven by rapid digital innovation and evolving consumer expectations. Insurtech, a portmanteau of “insurance” and “technology,” refers to the application of cutting-edge technologies such as artificial intelligence, machine learning, blockchain, IoT, and big data analytics to optimize the insurance value chain. The demand for faster claim processing, personalized insurance policies, real-time risk management, and enhanced customer experience is pushing both incumbents and new entrants toward adopting Insurtech solutions.

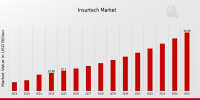

The Insurtech market Industry is witnessing robust growth with increasing investments from venture capitalists and growing partnerships between traditional insurers and technology firms. According to industry estimates, the global Insurtech market is projected to surpass USD 35 billion by 2035, expanding at a CAGR of 11.2% during the forecast period from 2025 to 2035. This surge is fueled by digital transformation initiatives, regulatory reforms supporting digital insurance platforms, and the rising penetration of internet and mobile devices globally.

Download Exclusive Sample Copy of This Report Here: https://www.marketresearchfuture.com/sample_request/11712

Market Key Players:

Several key players are shaping the trajectory of the Insurtech landscape by offering innovative digital tools and insurance platforms that streamline underwriting, claims management, customer engagement, and fraud detection. Leading firms include Lemonade Inc., Oscar Health, Root Insurance, Next Insurance, and Clover Health, which have redefined customer experience with direct-to-consumer business models.

Other major players such as ZhongAn Online P&C Insurance, Shift Technology, Trov Inc., WeFox, and Policygenius are pushing the boundaries with AI-based analytics, digital brokerage platforms, and embedded insurance services. Additionally, established insurers like Allianz, AXA, Munich Re, and Zurich are investing in or collaborating with Insurtech startups to enhance their digital capabilities. These key participants are focused on scalability, regulatory compliance, and product diversification to cater to an increasingly segmented and digitally-savvy customer base.

Market Segmentation:

The Insurtech market is segmented on the basis of type, service, technology, deployment model, and end user. By type, the market is categorized into health insurance, life insurance, property and casualty insurance, auto insurance, and others. Among these, health and auto insurance segments have gained significant traction due to growing demand for telemedicine, wellness analytics, and usage-based insurance models.

Based on services, the market includes policy administration, claims management, underwriting, billing, and others, where underwriting automation and digital claims processing are leading the segment growth. In terms of technology, the market comprises artificial intelligence, machine learning, IoT, blockchain, cloud computing, and big data analytics, with AI and blockchain playing pivotal roles in risk assessment and fraud mitigation.

Deployment models are divided into on-premises and cloud-based solutions, with cloud-based deployment gaining wider adoption due to its scalability and cost-efficiency. By end user, the market caters to insurance companies, third-party administrators (TPAs), brokers, and individual consumers, each leveraging Insurtech to enhance operational efficiency and improve user engagement.

Buy this Premium Research Report at: https://www.marketresearchfuture.com/checkout?currency=one_user-USD&report_id=11712

Market Drivers:

The Insurtech market is being propelled by several critical drivers that are fundamentally altering the dynamics of the insurance industry. Foremost among these is the growing consumer demand for digital-first experiences, characterized by mobile accessibility, personalized services, and real-time communication. Millennials and Gen Z customers expect seamless digital interfaces and self-service platforms, pushing insurers to innovate.

Another significant driver is the advent of artificial intelligence and machine learning, which enable predictive analytics for better underwriting and claims decisions. Additionally, the increasing adoption of IoT devices, such as smart home systems and wearable fitness trackers, allows insurers to collect real-time data and offer usage-based insurance policies.

Furthermore, regulatory frameworks in many regions are becoming more conducive to digital insurance products, encouraging innovation while maintaining consumer protection. The influx of venture capital into Insurtech startups is also a major catalyst, providing the necessary funding to scale operations and experiment with new business models. Together, these drivers are fostering a more agile, customer-centric, and data-driven insurance ecosystem.

Market Opportunities:

The Insurtech market presents abundant opportunities for stakeholders across the insurance and technology spectrum. One of the most promising areas is embedded insurance, where coverage is seamlessly integrated into the purchase of goods and services, such as travel tickets, electronics, or rideshare services. This model is expected to grow exponentially due to its convenience and contextual relevance. Another major opportunity lies in underserved and emerging markets, where digital platforms can bridge the insurance gap by offering affordable microinsurance products to populations with limited access to traditional financial services.

Moreover, Insurtech has immense potential to revolutionize claims management through blockchain-based smart contracts, which can automate claim validation and reduce administrative costs. The integration of AI and chatbots in customer service presents another avenue for enhancing client interaction and reducing human error. Collaborations between Insurtech firms and insurancers to co-develop innovative products tailored for niche segments, such as gig economy workers or climate risk coverage, also hold significant promise. These developments are poised to not only improve profitability but also expand market reach and inclusivity.

Regional Analysis:

The Insurtech market exhibits significant regional variation in adoption rates, investment patterns, and regulatory dynamics. North America, particularly the United States, holds the largest share of the global Insurtech market due to the strong presence of pioneering Insurtech companies, high digital literacy, and a mature insurance sector that is actively investing in digital transformation. Europe follows closely, with countries like the United Kingdom, Germany, and France witnessing accelerated adoption owing to supportive regulations, such as Open Insurance initiatives and a tech-savvy consumer base.

In the Asia-Pacific region, growth is being driven by massive mobile penetration and the need for scalable insurance solutions in populous countries like China and India. China’s Insurtech sector, led by giants like ZhongAn and Ping An, is notable for its innovation and massive user base. Meanwhile, India’s Insurtech ecosystem is flourishing with the emergence of startups focused on health and agriculture insurance. Latin America and the Middle East & Africa are also experiencing gradual growth in Insurtech adoption, driven by increasing financial inclusion efforts and digital infrastructure development. Each region is leveraging its unique strengths and regulatory climate to integrate Insurtech solutions into mainstream insurance offerings.

Browse In-depth Market Research Report: https://www.marketresearchfuture.com/reports/insurtech-market-11712

Industry Updates:

Recent developments in the Insurtech market highlight a wave of strategic partnerships, product innovations, and funding rounds that are reshaping the industry. Lemonade expanded its footprint in Europe by launching renters and pet insurance in multiple new markets, reinforcing its aggressive international growth strategy. On the technology front, Shift Technology introduced an upgraded AI-powered fraud detection tool that promises faster and more accurate anomaly detection.

Additionally, WeFox unveiled a digital insurance advisor using generative AI to offer real-time policy recommendations. Traditional insurers are also increasingly investing in Insurtech innovation hubs and accelerators to fast-track digital initiatives. Regulatory authorities in the EU and Asia are releasing new guidelines to enable digital-only insurance licenses, signaling greater institutional support for Insurtech growth.

Moreover, mergers and acquisitions have picked up pace, with large insurers acquiring promising startups to enhance their digital portfolios and gain competitive advantage. These industry movements underscore the increasing convergence of technology and insurance and point toward a future of hyper-personalized, efficient, and scalable insurance solutions.

Top Performing Market Insight Reports:

Augmented and Virtual Reality in Education Market: https://www.marketresearchfuture.com/reports/ar-vr-in-education-market-10834

Virtual Kitchen Market: https://www.marketresearchfuture.com/reports/virtual-kitchen-market-4493

Laser Technology Market: https://www.marketresearchfuture.com/reports/laser-technology-market-5109

Unified Endpoint Management Market: https://www.marketresearchfuture.com/reports/unified-endpoint-management-market-6419

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Services.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

market research future.

Market Research Future

+1 (855) 661-4441

info@marketresearchfuture.com

Source: EmailWire.Com

Source link